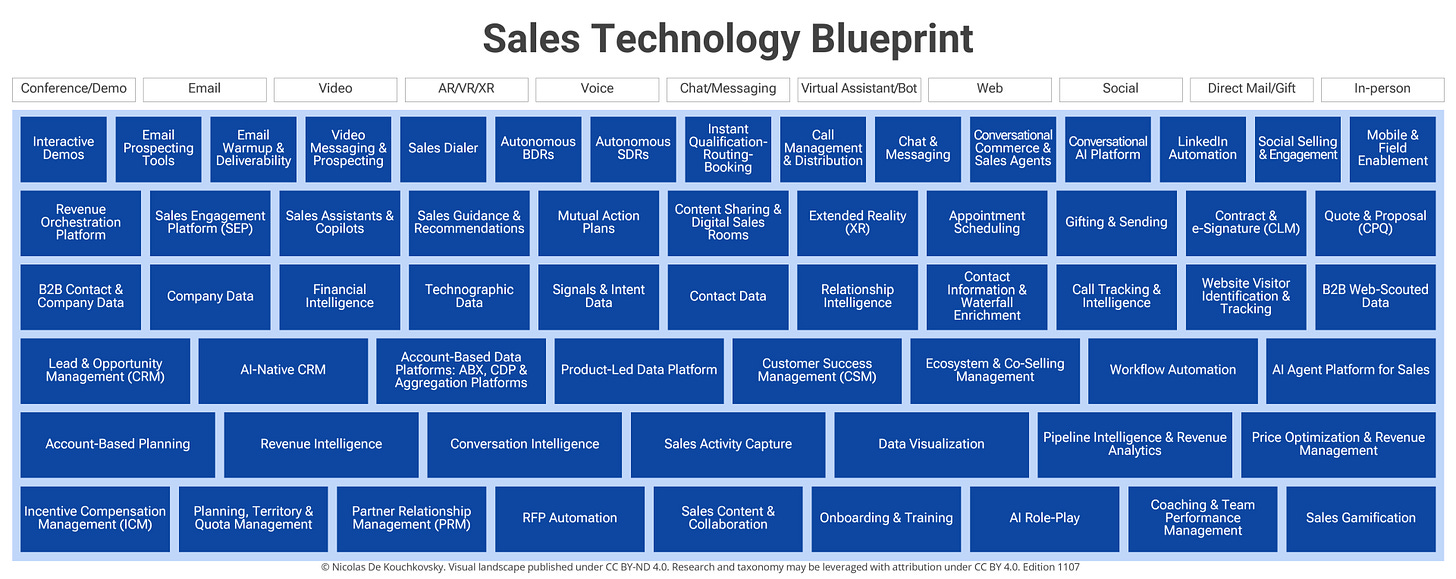

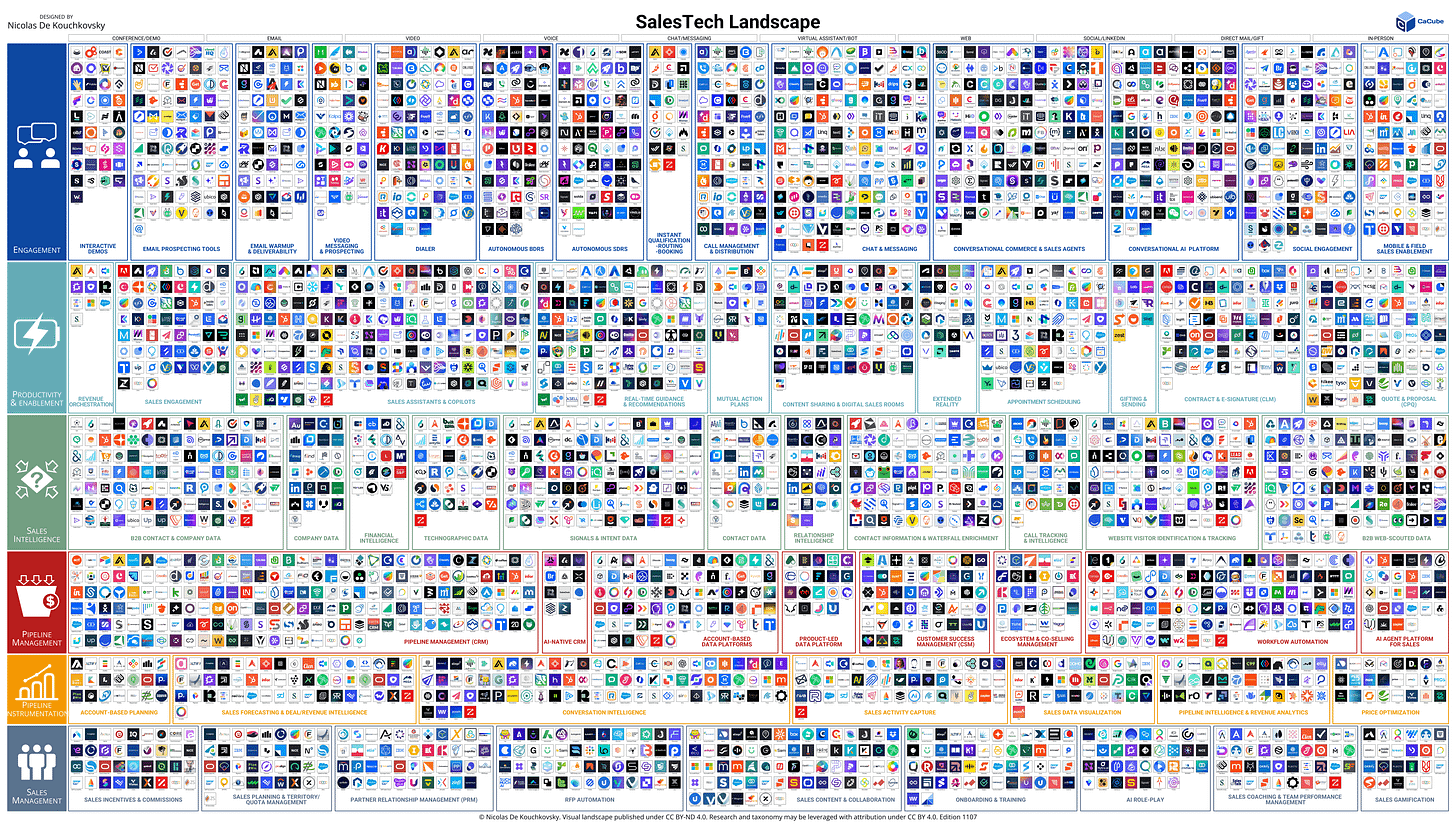

I’m excited to release the latest update of my SalesTech landscape.

This 11th edition was the most challenging to put together. It includes 2,130 participants, a modest 1% increase over last September’s version. By contrast, the 2024 landscape expanded by 34%.

The flat growth masks significant churn: more than 380 new entrants were offset by a similar number of exits and acquisitions. The influx of newcomers underscores how much AI has lowered entry barriers and how attractive sales and go-to-market use cases have become for its application. The exits and consolidations expose the other side of the equation: a saturated market crowded with fragmented solutions that are difficult to integrate, and vendors struggling to expand beyond the tech sector.

Agentic AI has made the landscape harder to analyze. Many vendors now call their products “agents,” even when they’re merely wrappers around commercial AI. The fate of these offerings remains uncertain and is already fueling a wave of pivots that are increasingly difficult to track.

This edition adds 4 new categories:

RFP Automation, now a standalone category

AI-Native CRM, discussed in a previous post

Revenue Orchestration Platforms, which extend Sales Engagement to include sales activity capture, conversation, and deal intelligence, and recommendations/next-best actions

AI Agent Platforms for Sales, enabling the creation of specialized agents that primarily handle non-customer-facing tasks

The landscape now tracks 60 categories, a number that illustrates the market’s fragmentation.

Unsurprisingly, Autonomous BDRs (+61%), Autonomous SDRs (+109%), and Conversational Commerce & Concierge Agents (+109%) are among the categories with the highest number of new entrants.

Sales Workflow Automation (+89%) is also experiencing significant growth, driven by the need to better stitch together fragmented stacks and the new AI-enabled ability to build automations.

Another category to watch is B2B Web-Scouted Data, formerly Internet Scouting & Search. AI has commoditized web scouting and scraping, enabling new entrants and allowing existing providers to expand their offerings.

Surprisingly, the industry has made only modest progress in delivering solutions for unified data repositories that integrate first-party data and federate third-party sources. While more categories now feature data aggregation, few players focus on data infrastructure capable of supporting all sales motions:

A few AI native CRM players have emerged, and only the largest CRM vendors have expanded their data layers

Account-based platforms remain largely focused on marketing campaigns and ads

Revenue execution platforms have been building data aggregation layers, but that capability has taken a back seat in their positioning

Once-hot categories like Product-Led Growth CRMs and Customer Data Platforms are shrinking

Interest has shifted to Clay-like workbenches that enable data manipulation. The result is a fragmented, hard-to-map landscape. I expect this to change as the need to manage all revenue motions from a single repository and feed AI drives renewed focus on unified data.

Inbound is poised for consolidation. It has historically been a patchwork of point solutions by channel or experience: appointment scheduling, live chat, conversational commerce, call tracking, call distribution, and lead routing. Some providers have already expanded into full qualification–routing–booking suites. After creating a mini category of autonomous SDRs and reinventing conversational commerce, AI will drive the unification of capabilities across channels, enabling seamless seller connections and streamlined appointment booking.

This edition seems to mark the end of one cycle and the beginning of another.

For a deeper discussion or to brief me on new offerings, schedule time during my office hours: here