Verint's Financial Analyst Day last December provided great insights into the company's strategic vision and path forward.

Verint is spearheading another major transition, its third since being founded in 1994 as a recording solution provider. It first transformed by pioneering the Workforce Optimization (WFO) market in 2006 when it acquired Witness Systems and integrated Workforce Management (WFM) and Quality Management (QM). Then in 2016, it morphed into a Workforce Engagement company, expanding beyond the contact center to address employee experiences holistically across the enterprise. Verint's latest transformation dubbed Verint 4.0 is turning it into a CX Automation company.

Verint claims an installed base of 4 million deployed agents handling 30 billion interactions annually. Assuming a worldwide population of 14.5 million agents, it represents an impressive 20% market penetration. The company also shared it was adding 100 new logos each quarter.

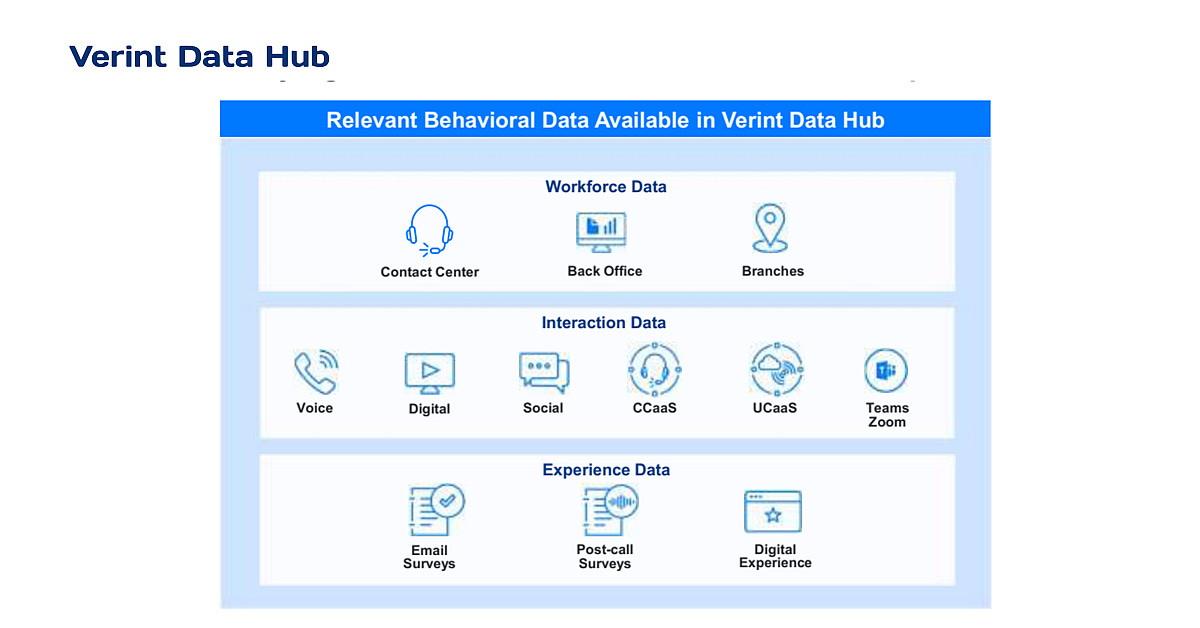

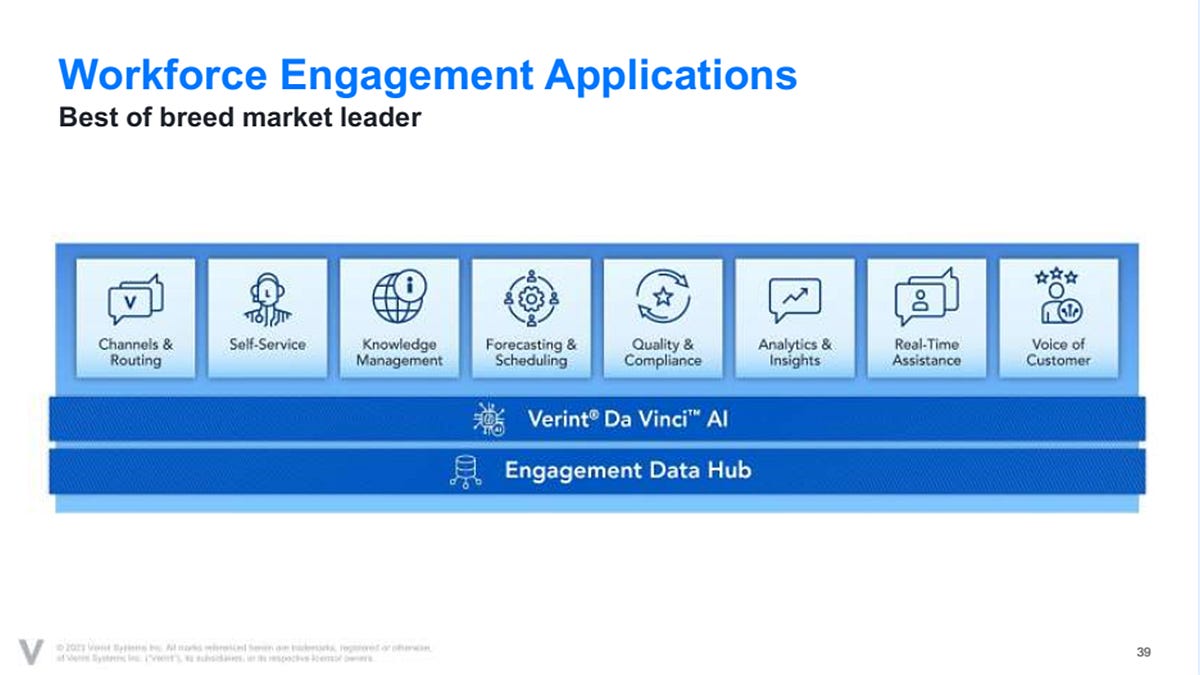

Its first pillar is an open platform that Verint sees as essential for the large enterprises it is targeting and that cannot rip and replace their investments to move to the cloud. It is built around its Engagement Data Hub, a data platform that combines workforce data, interaction data, and experience data such as surveys.

The second element of its strategy is a vision of people and AI working together, supported by an army of specialized bots. Today, Verint offers 35 of them like voice wrap-up assistance or self-service transfer. Bot specialization eases the introduction into existing workflows.

The third pillar is an AI "fabric" that lets enterprises leverage multiple models, picking the best for the task. For example, its wrap-up bot combines Azure OpenAI and AWS Bedrock. Verint DaVinci is Verint's umbrella name for the company's own AI models. Verint describes DaVinci as a bot factory and is planning to add a new bot every few weeks. These bots serve both customer-facing agents and other roles within customer service operations.

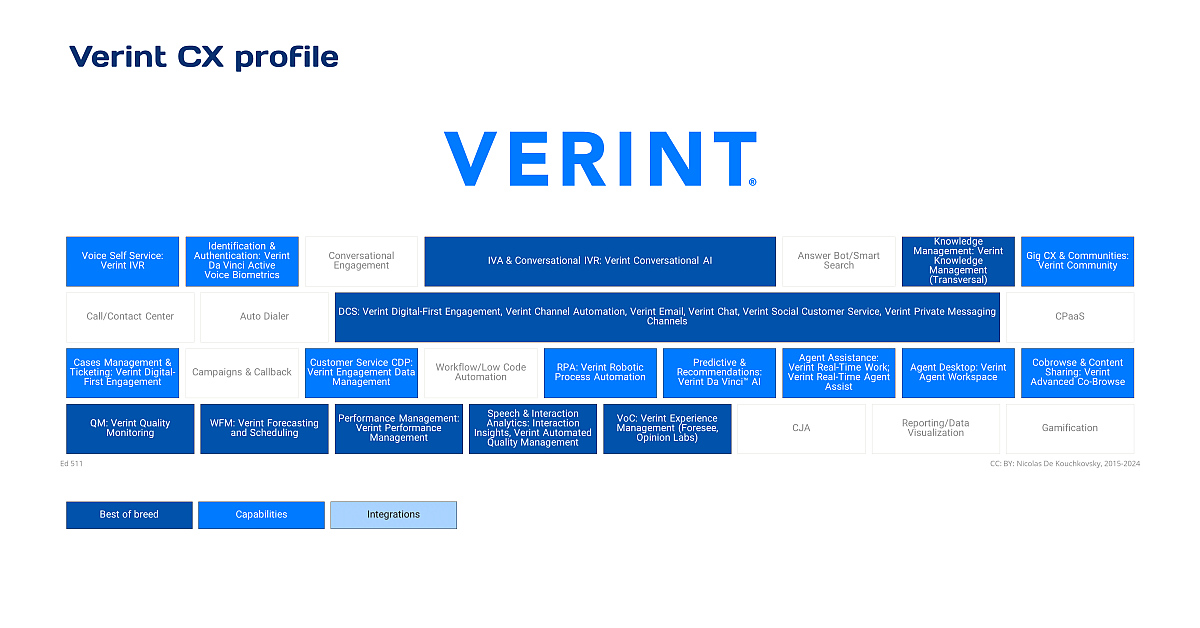

Built on this foundation, Verint offers a set of applications:

To demonstrate the value of its bots, Verint shared its outcome-based pricing on an example of a 2,000-agent contact center facing a 20% yearly increase in interactions. By deploying a mix of four bots, the center could absorb all extra volume with no staff increases:

Interaction Wrap-Up Bot: Used for 100% of interactions

Knowledge Suggestion Bot: Used for 50% of interactions

Performance Coaching Bot: Used for 50% of interactions

Voice Containment Bot: Used for 10% of interactions

Without bots, the center would have hired 400 more agents to handle the added interactions. Instead, the bots enable flat headcount.

From a Verint perspective, the $200K missed revenue opportunity of these 400 incremental agents ($40/agent/month) is more than offset by the estimated $1,300K revenues of the 2.1 full-time bots assisting each of the customer service reps ($25/bot/month).

That being said, Verint projects only a small reduction in the agent population over the coming years. This modest outlook stems from observing DaVinci over its 3-year existence. Rather than decreasing workforces, Verint finds that AI enables customers to handle rising interaction volumes without proportionate staff increases.

Being a financial analyst event, the transition to the cloud and the path to profitability was discussed pretty extensively. Verint started its cloud journey with a hosting model allowing partners to host its software. It calls this unbundled SaaS in contrast with its SaaS offering (bundled SaaS) which is Verint's go-forward offering and will progressively replace its unbundled offers. The evolution of the cloud mix combined with the continued decline of perpetual licenses has already driven a gross margin (GM) improvement to 69% (GAAP), up from 65% two years ago.

The event showcased Verint's maturing vision and increased focus on automation.