Over the years, customer communications have grown into a prominent part of what an enterprise communications infrastructure needs to support. This started in the late 1990s with call centers, followed by B2B inside sales. Both cases led to the creation of new software categories.

Similarly, COVID-19 and digitization today are changing B2C sales, creating new engagement workflows. Businesses and consumers are widely adopting digital and virtual selling, leveraging the latest communication technologies and paving the way to a new breed of software. This post explores the evolving world of B2C sales communications and discusses the new "communications-enabled” ways of selling.

A bit of history

In the world of customer engagement, the sales role has historically been underserved by technology. While salesforce automation (SFA) took off in the 1990s, it served primarily to provide finance executives visibility into the sales pipeline rather than as a tool for sales reps themselves. With the mid-2000s came the rapid development of CRM for customer service and marketing (marketing automation), but this didn’t do much for sales, either.

B2B vs. B2C

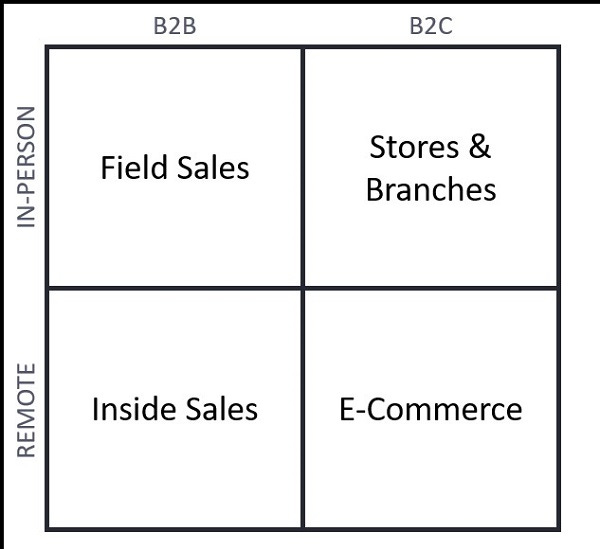

As we discuss sales evolution, it’s important to appreciate the differences between business-to-business (B2B) and business-to-consumer (B2C). B2B involves high-priced products and services, long sales cycles, and complex purchasing decisions with multiple buyers. B2C is simpler, with fast selling to one, or maybe two, buyers. B2C sales traditionally take place in branches, stores, or over the phone, while B2B sales require field sales representatives. Velocity and scale are two attributes that make B2C different from B2B.

E-commerce

Saying that the early 2000s didn’t see any progress in technology for sales is not totally true. Amazon launched in 1995, and e-commerce emerged. In 2000, Amazon reported $3 billion in revenue, a paltry amount compared to the $180 billion in revenue Walmart posted that same year. By the end of the decade, however, Amazon's revenues had grown 10x. E-commerce, which has grown steadily over the years, now represents 15% of retail sales in the U.S.

E-commerce has become an important B2C sales channel for commodity products sold on a self-service basis. Its expansion has become more dependent on omnichannel experiences allowing associates to help during the consideration process or with the purchasing decision.

The rise of B2B inside selling

The 2008 downturn provoked a major change in how businesses looked at sales, and improving sales productivity became highly important for B2B companies in particular. They started to use inside sales, a cost-effective way to engage prospects and drive the initial stages of a consideration remotely. Communication tools such as phone systems and email are critical for inside sales, allowing reps easy means of reaching out to and following up with prospects, as well as tracking activities.

The inside sales movement led to the creation of a new breed of software — for sales engagement — that mirrors many applications you can find in contact centers. Sales engagement lets sales development representatives engage with prospective buyers using email, voice, or social channels. Sales engagement officially became a category of its own a few weeks ago with Forrester’s first Wave report on these tools.

Conversational intelligence, which uses AI to analyze recordings of sales calls, is another application borrowed from customer care. In this case, the goal of conversational intelligence is to uncover insights and success patterns or lead distribution that assigns incoming leads to reps based on a sophisticated set of rules.

When COVID-19 forced field sales to stay at home, B2B sellers could turn to these applications and switch to remote selling. The availability of technology is now allowing B2B to settle into a new “selling from anywhere” mode, blending inside and field selling, with a much larger chunk of activities happening remotely.

B2C sales left behind?

B2C was left behind B2B with the adoption of inside selling. While some companies have deployed live chat on websites to assist prospective customers, the impact of this technology has been limited. Wait times of a minute or more persist, and most businesses don’t know how to set expectations for customers on how long it will take to speak with a human. The number of unanswered chats has stayed high.

In part, this is because companies struggle with the staffing model for live chat. Many end up outsourcing live chat to agents who lack the information and knowledge to provide effective assistance to potential buyers. To address responsiveness, they turn to bots and conversational assistants, but these are limited to simple inquiries.

The next frontier: Assisted B2C sales

With the pandemic forcing businesses to close branch offices and stores, B2C businesses had to switch overnight to digital and remote selling. At the same time, consumers not only became comfortable with buying online but also began to desire to perform more of their buying journey online and on mobile devices. These coinciding trends are changing B2C sales for the long term.

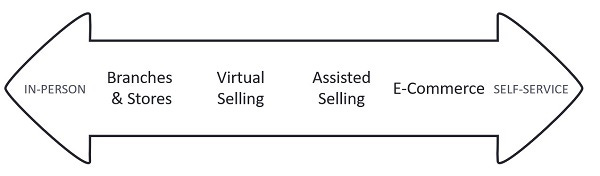

Two new options, virtual selling and assisted selling, are emerging. Keeping in mind consumers are in control of their buying journey and navigate across options, we can plot them between e-commerce and brick-and-mortar:

In the virtual selling model, B2C businesses assign advisors to customers. By letting advisors work from anywhere, businesses can scale the model. It’s not unusual to see advisors managing over 50 clients, as we’ve seen among financial services firms that have pioneered the model. Virtual selling has helped banks stay connected and engaged with customers even while branches were closed during the pandemic. The model is evolving with advisors not just responding to inquiries but proactively managing relationships.

Assisted selling addresses situations where the assignment of advisors is neither economically feasible nor practical. It comes through multiple motions:

Modernization of telemarketing – As sales of commodity products transition to e-commerce, telesales operations are shifting their focus to higher-value products. To do so, they need to leverage all channels to reach out to consumers and better equip associates to discuss sophisticated offerings and handle emotional buying decisions.

Rapid lead response – Besides offering chat and messaging options, businesses must provide immediate callbacks to online visitors interested in their products or services. One academician’s study shows the odds of reaching a lead drop by 100x if called within 30 minutes instead of within five minutes. For most businesses, the target time is 120 seconds.

Service-to-sales – A growing number of businesses base their B2C models on trials and expansions, recurring sales, or subscriptions. Their success hinges on ensuring a great experience and continuing customer development. Many businesses cannot assign advisors. Instead, they need to leverage every customer interaction to retain, develop loyalty, and grow their customer base. It entails leveraging customer service interactions and developing low-cost sales touches.

Businesses have accomplished a lot using existing communication solutions. However, B2C businesses are finding that scaling these motions requires specific workflow and outreach tools. Like B2B inside selling led to the formation of a new industry, you can expect that the rise of B2C-assisted selling will fuel the creation of new categories of software.

This post was originally published on No Jitter