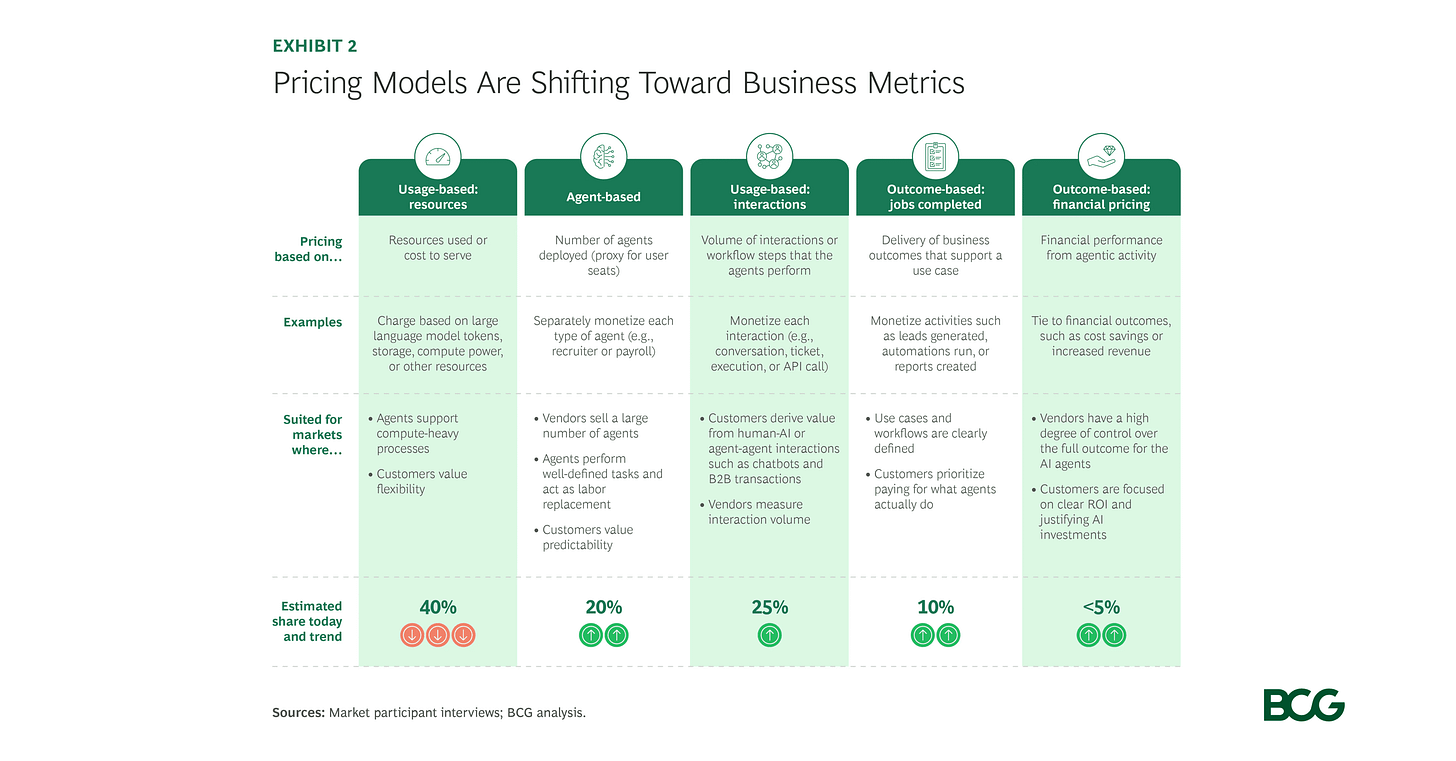

Last month at the KeyBanc/Mosaic Summit, one theme dominated my conversations with investors: the shift from legacy SaaS per-seat pricing to consumption- and outcome-based models.

The topic is so top of mind it now has its own three-letter acronym: UBP (Usage-Based Pricing).

Concerns about the SaaS model are valid, but investors’ fixation on pricing structures blinds them to other forces reshaping software businesses.

I’m seeing less seat reduction per se and more a two-pronged vendor consolidation: first, similar departmental software being unified onto a single, enterprise-wide solution (“horizontal consolidation”); second, best-of-breed vendors whose features sat on top of suites being absorbed into those broader ecosystems (“vertical consolidation”).

Seat counts and tier selection are also under intense scrutiny, with companies buying only what they truly need. Most SaaS vendors offer ‘good-better-best’ pricing, often with wide gaps, and many have added premium ‘pinnacle’ or ‘ultimate’ tiers. Businesses are increasingly questioning upgrades for incremental features, especially with AI agents on the horizon. Vendors must now prove the value and ROI of every higher-tier offering.

In this context, investors should evaluate a provider’s strategic position both in seat coverage and tier adoption.

Next comes AI. Its capabilities cut across product categories, giving customers more options, including building their own. At this stage, investors should look beyond a provider’s short-term ability to monetize AI features to evaluate how the adoption of a vendor’s AI capabilities positions it to become a true AI platform for its customers.

Eventually, consumption- and outcome-based pricing is no panacea. A recent Andreessen Horowitz survey underscores the challenges:

47% of buyers struggle to define clear, measurable outcomes

36% worry about cost predictability

25% face difficulty aligning on value attribution with vendors

24% acknowledge that outcomes often depend on factors beyond the vendor’s control

This doesn’t mean clinging to legacy seat-based models. Nor does it dismiss the need for pricing evolution to improve margins.

Here’s the point: investors should expect a deliberate, gradual transition and assess a vendor’s position holistically amid SaaS saturation and the early innings of AI adoption.

Off the soapbox.