Twilio hosted an investor conference 10 days ago, offering highly insightful takeaways. Since its last investor day in 2022, Khozema Shipchandler has succeeded founder and industry icon Jeff Lawson as CEO, refocusing the company on a path to profitable growth.

Plenty to unpack—let’s dive in.

Starting with financial performance, Twilio has reached important milestones.

After several quarters of growth deceleration, the company revealed 11% YoY growth for 4Q24, following 10% growth in the previous quarter. Acknowledging the challenges of its consumption-based pricing model, Twilio refrained from providing formal guidance. Instead, it outlined a 7-8% growth assumption, emphasizing that its long-term strategy is designed to deliver double-digit growth. The company also pointed to Gartner estimates, positioning it as the CPaaS market share leader and showing it outpacing its four closest competitors in growth.

On profitability, Twilio will achieve GAAP profitability in 2025 and maintain it thereafter. It also committed to delivering over $3 billion in cumulative free cash flow from 2025 through 2027.

These are solid results after several quarters of rigor, discipline, and difficult cost reductions. For instance, its sales headcount was cut by 50% from 2022 levels. I’m hopeful these results will reassure the financial community and activist investors.

A core tenet of Twilio's profitable growth is its efficient GTM engine. The company has relentlessly optimized its self-service motion. While self-service accounts for only 15% of revenue, it has driven customer acquisition for those contributing 65% of revenue, fueled by upsell and cross-sell.

The company reported that ISVs accounted for 24% of revenue, driven by a mix of large players like Zendesk and a long tail of smaller ones. After past friction following the introduction of its applications, Twilio has been retrenching from areas where it competed directly with ISVs. The company is now focusing on RCS and other messaging-based services to grow its higher-margin software products.

Twilio aims to re-invigorate its innovation engine with a vision of making every digital interaction between a business and a consumer amazing. This vision is built on integrating communications, contextual data, and AI.

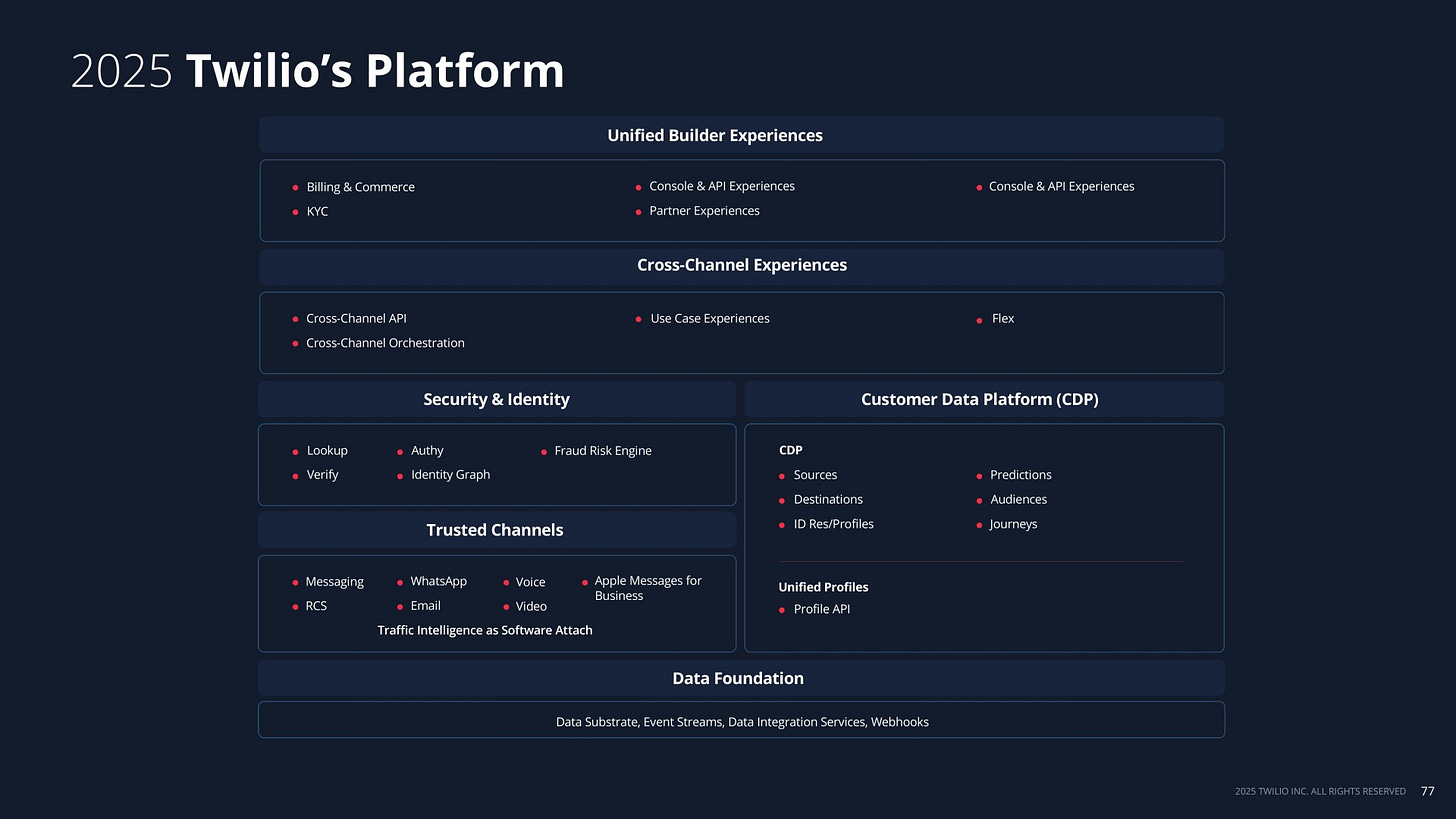

The company positions itself in the converged CXaaS space, combining CCaaS, CPaaS, CDP, and AI. It estimates a $39B incremental market opportunity on top of the $119B sum of its parts by 2028.

I noted the central role of Segment CDP in the vision. Segment had been carved out as a business while Twilio explored its options. Moving forward, Twilio will market it as both a standalone offering—committing to simplifying deployment—and an integrated capability of its communication platform via unified profiles. Bringing together data and communications was music to my ears.

Flex—the company’s CCaaS offering—was notably absent from the discussion, mentioned only once. From a financial reporting perspective, it is grouped with smaller products, representing 17% of total product revenue. I estimate its share of these other products to be around 20%, which would place its revenue at approximately $150M.

On the AI front, Twilio offers AI assistants, Virtual Agents, and Agent Co-pilot, primarily leveraging its Google and OpenAI partnerships. It is using them internally to deliver impressive results, handling 80% of inbound sales leads and deflecting 75% of support tickets.

I’m optimistic that these strong strides will reassure financial investors, allowing Twilio to prioritize innovation. Moving forward, I’d like to see more insight into the customer engagement layer it is building and its ambitions in the CXaaS space. Additionally, I’m eager to learn more about Twilio’s broader AI strategy—beyond Voice Intelligence and AI assistants—to capitalize on the emerging Voice AI space and capture its unfair share of the voice market in its full renaissance.