Three months ago, Tod Famous challenged us to reconcile Genesys Cloud ARR growing nearly 35% year over year with a cloud contact center market growth rate of 12%.

The 12% market growth rate reflects the average of public companies. It aligns with the SaaS new normal and exceeds Gartner’s forward-looking 9% projection.

Genesys defines Cloud ARR as fiscal quarterly revenue, combining committed contracts and usage-based revenue, multiplied by four, making it a somewhat apples-to-oranges comparison.

The difference still feels significant. After Genesys reported third-quarter metrics with Cloud ARR approaching $2.4B, up more than 30% year over year, I received another wave of questions about the contact center market growth that pushed me to dig through all its announcements to estimate its revenue trajectory.

The exercise was not trivial: some announcements read like a treasure hunt, for example, “after exceeding $250M during the second quarter, Genesys Cloud AI ARR continued its strong momentum, with a year-over-year rate more than twice that of Genesys Cloud ARR and accelerating from the previous quarter.”

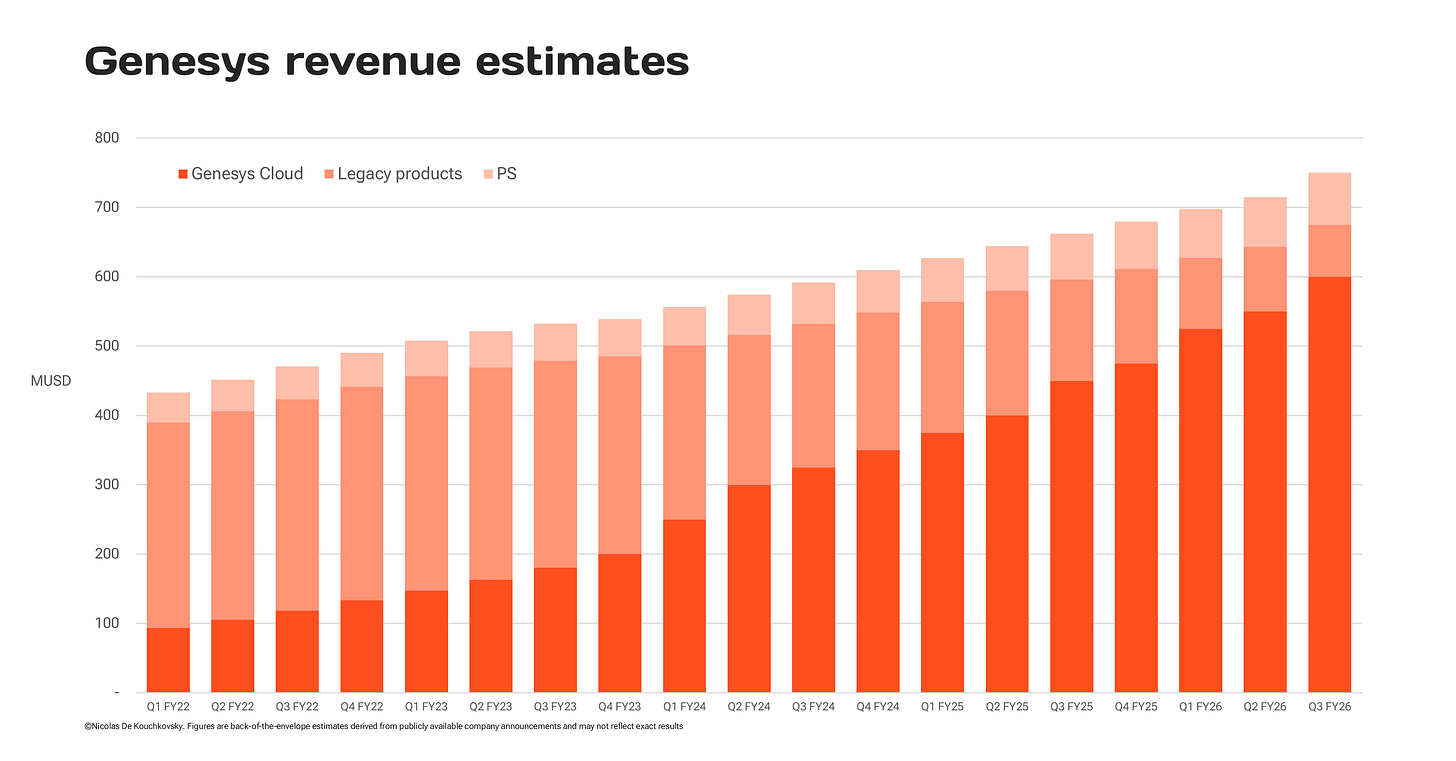

After some triangulation, I was able to piece together quarterly revenues by cloud, legacy products, and professional services. The attached chart shows my findings. Keep in mind, these are back-of-the-envelope estimates.

I find that the company’s last-quarter cloud revenues grew an impressive 33%. Turning the on-premises installed base into cloud customers has been driving a significant portion of growth. Genesys appears to be executing this exceptionally well, a remarkable performance given the angst its legacy product’s end-of-life announcement generated and the fate of other on-premises providers whose installed bases have plummeted. Total product revenue grew a solid 13%.

Reports of the end of contact center growth have been greatly exaggerated.