I thought that 2022 would mark the expansion of customer data platforms (CDPs) from their early marketing and commerce use cases into sales and service.

Instead, we saw the blossoming of architecture options to build a unified customer data model and allow more cohesive customer journeys and experiences.

Let me go over your options.

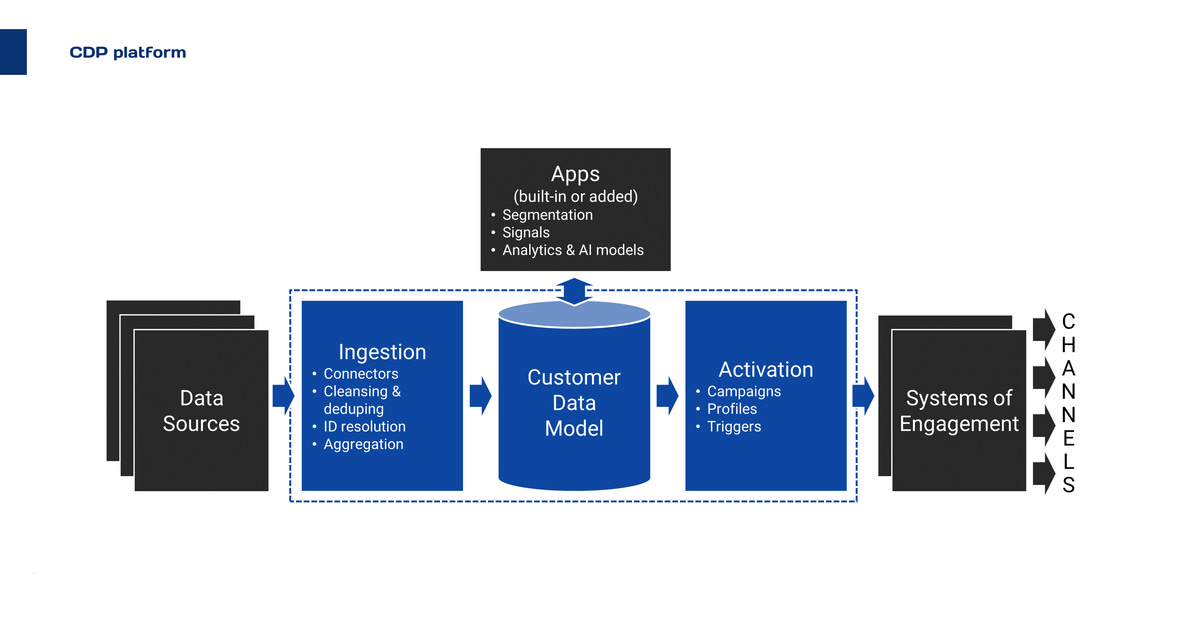

CDP Platforms

Traditional CDP platforms combine

data ingestion;

a unified data model; and

activation via segmentation, personalization, and triggers feeding systems of engagement.

I call them CDP platforms but could as well call them headless CDPs. They have stayed focused on advertising, B2C marketing, and commerce applications.

Segment & Treasure Data remain the 2 most aggressive players foraying into sales and service.

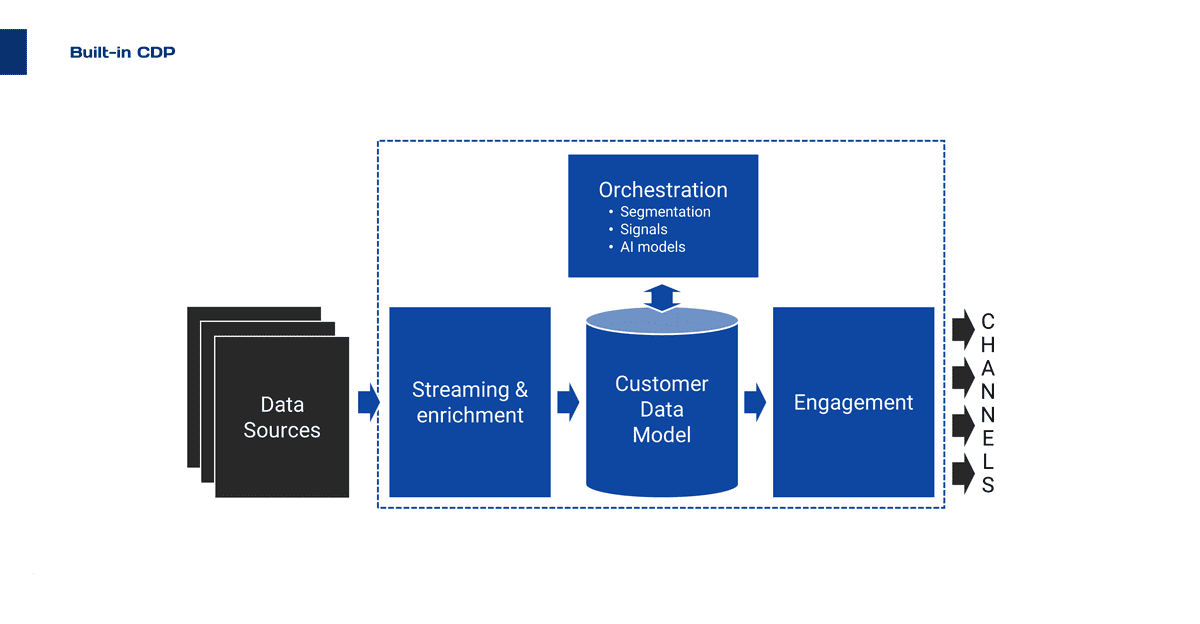

Built-in CDPs

A growing number of systems of engagement vendors have transitioned to a CDP architecture. It materializes with a broader/more open data model ‘inside’, fed using prepackaged connectors that pull relevant data from 3rd party sources.

Their data models are less focused on putting together customer 360 views but rather on combining the insights needed to trigger relevant engagements or drive personalized experiences. They also provide the data foundation for their AI models. Data is available to 3rd party systems but models are purpose-built.

Examples of prominent providers having embedded a CDP in their stack include:

6Sense, DemandBase, ZoomInfo for account-based orchestration

Braze for real-time customer engagement; and

Verint for customer service.

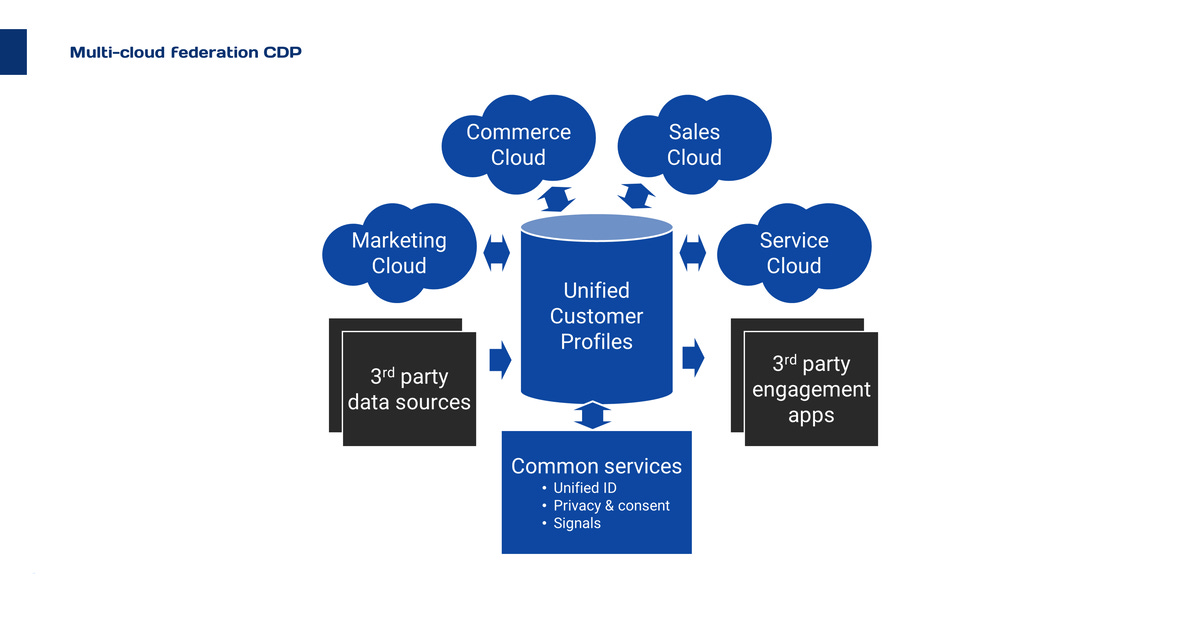

Multi-cloud federation CDPs

The large SaaS suite providers — Microsoft, Salesforce, SAP, and Oracle — have also embraced the CDP model.

Their CDPs aim first and foremost at federating the data spread across their multiple clouds. They provide unified identification and data-related services, such as privacy control and consent management.

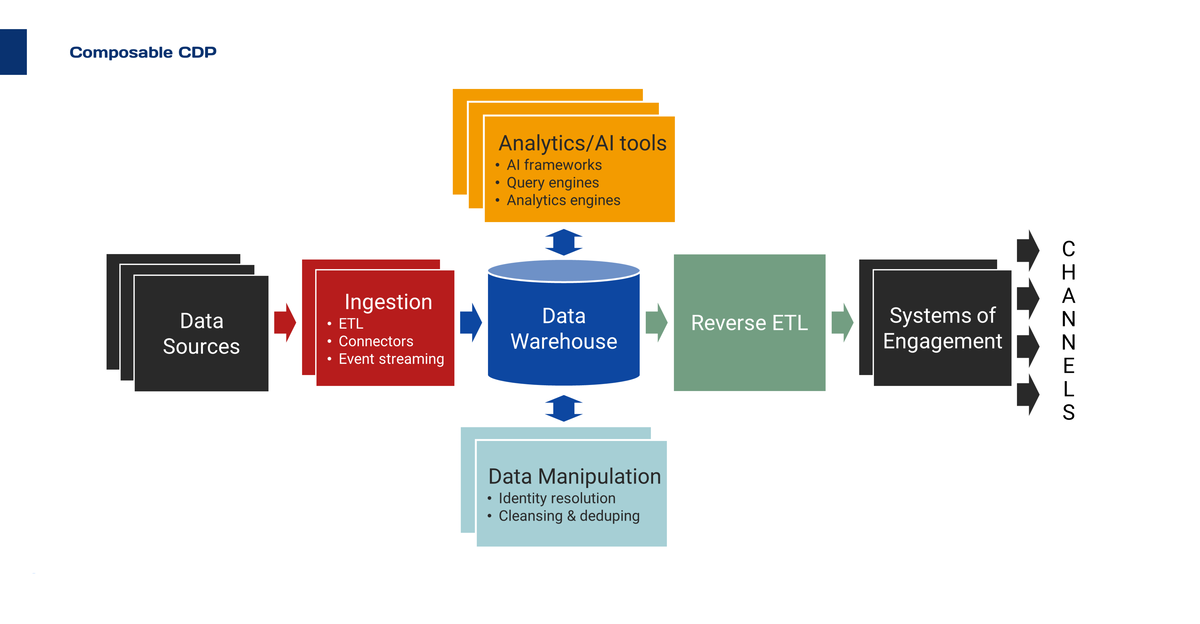

Composable CDPs

This architecture variant lets you create a CDP by assembling cloud data services and components. The CDP stack gets disaggregated into its 3 layers, ingestion, data, and reverse ETL with plugged-in services.

Many enterprises have been on a journey to build a data warehouse. Already, they can pull data from multiple sources using ETL services.

In 2022, Snowflake introduced its Native Application Framework. It lets you plug native apps that can manipulate the data inside the warehouse without having to move or replicate the data. It has brought the cloud services, such as identity resolution, cleansing, and data augmentation, required to create a unified data model.

You then add reverse ETL software from the likes of Census, Hightouch, Integrate.io, and Rudderstack to activate your data and feed your systems of engagement.

Snowflake was the first mover but was rapidly followed by all cloud hyperscalers — AWS, Google, and Microsoft — to offer the architecture and the building blocks required for this DIY approach.

Composable CDPs are very flexible solutions but hinge on developers.

Having options is always good. It also shows that the CDP model is gaining traction. While some of these options may work together, they require businesses to think through their strategy and architecture.